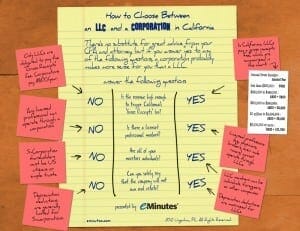

Our friends and sponsor over at eMinutes just came out with this excellent infographic outlining how to choose between and LLC and a corporation in California. I think this is pretty excellent because there is so much information out there about both options and most of it is rather confusing. While IdeaMensch is an LLC (not a California one), I had no idea that the rules differ state-by-state and as the case is in California – there are a bunch of junk fees. Did you know that in California the initial $800 franchise tax is waived for corporations, but not for LLCs. That would have actually kept me from forming an LLC in California – especially when we were first getting started and really had no revenues. Anyways, there are a number of factors that go into this and this infographic outlines the most important.

If you are in California, this is immensely useful. If you are not in California, this should inspire you to figure out exactly what the conditions are in your state.

Mario Schulzke is the Founder of ideamensch, which he started a decade ago to learn from entrepreneurs and give them a platform for their ideas.